tdmcourse.ru

Overview

Paying Extra On Mortgage Principal

So paying additional amounts incrementally is better. Your return on those additional payments is % per year for the period between when you. Making an extra payment equal to each month's principal payment will approximately halve the life of the mortgage, but it requires a rising payment over. Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down. Paying extra towards mortgage can save you thousands of dollars and help you build equity faster. Here are some ways to prepay a mortgage. Some homeowners decide to make voluntary extra payments on their mortgage principal to pay off their homes sooner. Extra payments are generally. It would be best to pay additional principal on your mortagage monthly. The sooner that the additional amount is subtracted from your principal. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Your proposed extra payment per month. This payment will be used to reduce your principal balance. Current mortgage payment: Monthly principal and interest. 1. Make one extra payment every year · 2. Make recurring principal-only payments · 3. Split your monthly mortgage payment in half and pay that amount every two. So paying additional amounts incrementally is better. Your return on those additional payments is % per year for the period between when you. Making an extra payment equal to each month's principal payment will approximately halve the life of the mortgage, but it requires a rising payment over. Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down. Paying extra towards mortgage can save you thousands of dollars and help you build equity faster. Here are some ways to prepay a mortgage. Some homeowners decide to make voluntary extra payments on their mortgage principal to pay off their homes sooner. Extra payments are generally. It would be best to pay additional principal on your mortagage monthly. The sooner that the additional amount is subtracted from your principal. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Your proposed extra payment per month. This payment will be used to reduce your principal balance. Current mortgage payment: Monthly principal and interest. 1. Make one extra payment every year · 2. Make recurring principal-only payments · 3. Split your monthly mortgage payment in half and pay that amount every two.

One time extra payments refer to additional payments that are made to the principal balance of additional amount of principal to your current monthly mortgage. Use this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. Making extra payments on your principal mortgage balance, which is the amount you borrowed, may help you reduce the amount of interest you pay over the life of. There are three primary methods for making extra payments – pay extra each month, make a lump sum payment or switch to bi-weekly payments. Paying extra each. Making extra payments of $/month could save you $60, in interest over the life of the loan. You could own your house 13 years sooner than under your. Making extra mortgage payments — and applying them to the principal — reduces your principal balance little-by-little, so you end up saving money and owing. Generally, national banks will allow you to pay additional funds towards the principal balance of your loan. However, you should review your loan agreement. As you make extra payments, the principal balance—or the original amount borrowed—decreases. As a result, you pay less in total interest over the life of the. Pay off your mortgage early by adding extra to your monthly payments. NerdWallet's early mortgage payoff calculator figures out how much more to pay. The faster you pay off your mortgage principal, the less interest you owe. For example: if you have a year mortgage but end up paying your mortgage off. Tips to pay off mortgage early · 1. Refinance your mortgage · 2. Make extra mortgage payments · 3. Make one extra mortgage payment each year · 4. Round up your. Putting more money towards the principal balance will help you pay less in interest over the life of the loan and will shave time off of your term so you can. By paying extra $ per month starting now, the loan will be paid off in 17 years and 3 months. It is 7 years and 9 months earlier. This results in. The additional amount will reduce the principal on your mortgage, as well as the total amount of interest you will pay, and the number of payments. All fields. Send your mortgage lender a one-time, additional principal payment. · Pay your mortgage lender a monthly “prepayment” of the principle. · Pay points if necessary. Depending on your financial situation, paying extra principal on your mortgage can be a great option to reduce interest expense and pay off the loan more. Attacking the principal with extra monthly payments lowers the amount of interest you pay over the life of the loan. A common strategy is to divide your monthly. Many mortgages let you pay off the loan early to save money on interest. You can do this by paying extra each month, making an extra payment every year, or. By paying more than your required monthly mortgage payment, you can put that extra money directly toward the principal amount on your loan. Your interest. Nearly all mortgages allow the homeowner to make additional payments monthly or in a lump sum towards your principal. Regardless of the amount of funds applied.

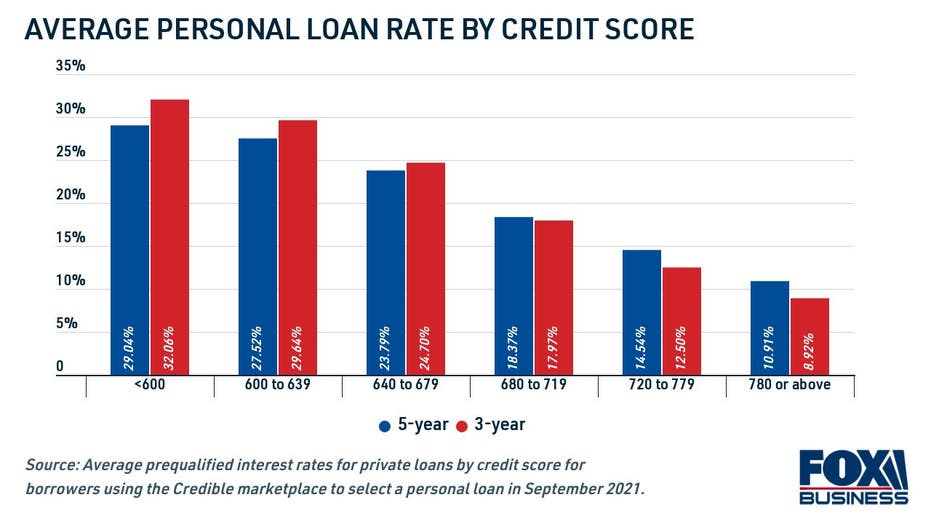

Who Has The Lowest Personal Loan Rates

personal loan at a lower APR and am looking for insight on low personal loan rates for this "new" loan. Archived post. New comments cannot. Personal loan features. Terms up to 5 years²; Personal loan interest rates as low as % APR; No application fees; No collateral required. Today's Rate. Quick funds for all your needs · As low as % APR · No hidden costs or fees · No collateral required. Use your Savings or Certificate to secure a low-cost loan. The interest rate The Credit Union does not endorse or guarantee the products. Personal loan interest rates as low as % APR 1, 2 APR includes a % relationship discount. Signature Loan APR (As Low As) $$30,, % · Signature Line of Credit APR (As Low As) $,, % · Secured Signature Personal Loans Fixed. Truist offers fixed rate unsecured personal loans starting at $ Apply now to consolidate debt, pay for home improvements, or manage big expenses. have the lowest overall debt. Zoom between states and the national map to see where people have the lowest credit card, auto and mortgage debt. Share. More. LightStream Personal Loans · · None ; Prosper Personal Loans · · 1% to % ; Upstart Personal Loans · · 0% to 12% ; Discover Personal Loans · · None. personal loan at a lower APR and am looking for insight on low personal loan rates for this "new" loan. Archived post. New comments cannot. Personal loan features. Terms up to 5 years²; Personal loan interest rates as low as % APR; No application fees; No collateral required. Today's Rate. Quick funds for all your needs · As low as % APR · No hidden costs or fees · No collateral required. Use your Savings or Certificate to secure a low-cost loan. The interest rate The Credit Union does not endorse or guarantee the products. Personal loan interest rates as low as % APR 1, 2 APR includes a % relationship discount. Signature Loan APR (As Low As) $$30,, % · Signature Line of Credit APR (As Low As) $,, % · Secured Signature Personal Loans Fixed. Truist offers fixed rate unsecured personal loans starting at $ Apply now to consolidate debt, pay for home improvements, or manage big expenses. have the lowest overall debt. Zoom between states and the national map to see where people have the lowest credit card, auto and mortgage debt. Share. More. LightStream Personal Loans · · None ; Prosper Personal Loans · · 1% to % ; Upstart Personal Loans · · 0% to 12% ; Discover Personal Loans · · None.

Personal loan interest rates as low as % APR 1, 2 APR includes a % relationship discount.

Personal loan rates as low as % APRSee note1. With no application or How does it work? You can apply online and give the same kind of details. Upstart Personal Loan Got Rate page It's important to remember that while you may qualify for a personal loan with low credit, your loan may come with higher. What to know first: The best personal loan rates start below 8 percent and go to the most creditworthy borrowers. Personal loan interest rates currently. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. Discover offers personal loans from $2, to $40, with terms from three to seven years and APRs as low as %. This could make it a great choice for. Personal Loan Rates ; Personal Loan, Fixed & as low as %** ; Term Share Certificate Secured Loan, %*** ; Overdraft/Line of Credit, Variable & as low as. SoFi · % to % · ; LightStream · % to % · ; First Tech Federal Credit Union · As low as % · No minimum ; PenFed Credit Union · % to While LendingClub does not charge an application fee on any of its loans What is a Good Interest Rate: Tips to Getting the Best Personal Loan Interest Rate. These unsecured loans can be helpful for small home improvements, debt consolidation, unexpected expenses and more. We have some of the lowest rates and fees. Compare personal loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Prosper · · Loan term. 2 - 5 years. Top picks from our partners ; Best for Large Amounts: SoFi. SoFi logo. · Good - Exceptional · - % · 24 - 84 mo ; Best for Debt Consolidation: Happy Money. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. Borrow up to $ with a no fee, low rate personal loan. Apply for a d/b/a/ Rate has % ownership and a direct or indirect financial interest. RCU offers a variety of personal loans, including signature loans and even bike loans with low rates and flexible terms that meet your needs. LightStream's low advertised minimum APR is the lowest, widely available, rate currently in our database. A couple of lenders can beat it—American Express. With low rates and flexible terms, our personal loan options help you manage unplanned expenses or get some extra cash. Consolidate them to stop juggling expenses. Have a big purchase coming up? Avoid high-rate financing with a low-rate APGFCU® personal loan. Save more of. Hawaii State FCU offers personal loans with flexible credit limits, low rates, and easy repayment options suitable for your needs. Apply online today! Rates are fixed, so your payment doesn't change. · Interest rates as low as % APR. · Up to $30, in one lump sum. · Funds are typically available the same.

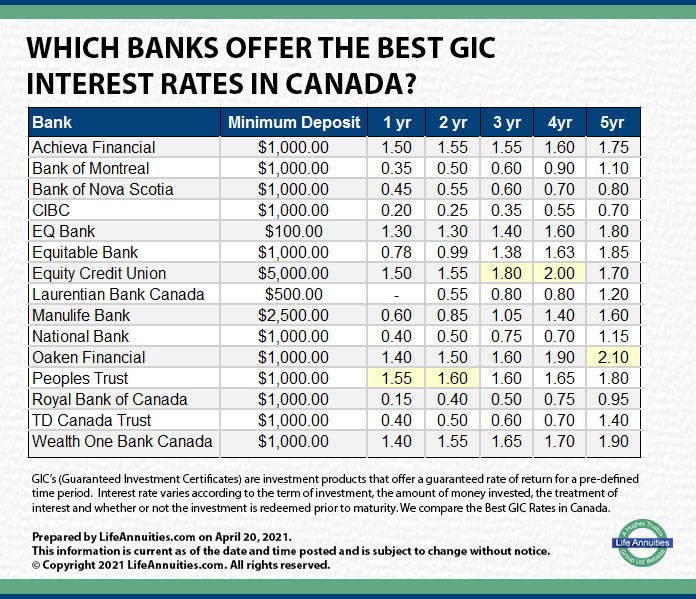

Gics Rates Canada

Currently the most competitive one-year GIC rate is %, offered by Saven Financial, Oaken Financial, WealthOne Bank of Canada, MAXA Financial and ICICI Bank. GIC short term · 1 year GIC. Redeemable after 30 days without penalty. Canadian banks. %. ,$+ · 2 month GIC. Non-redeemable. Canadian banks. %. There is no minimum interest rate guarantee and actual interest rate could be as low as 0% over the 2-year term and 3-year term. Minimum investment is $ Featured GIC Rates · % · % · %** up to % · Stay safe and secure · Customize your solution · Save on taxes. Each year one GIC will mature and you can reinvest the money into a new 5 year GIC: If interest rates increase, you can reinvest at a higher interest rate. If. Our featured GICs and their rates ; %. 12 ; %. 18 ; %. 24 ; %. %. 2-Year BMO GIC 6footnote 6. An ideal investment that provides guaranteed interest for a short-term savings goal. · %. 12 Month BMO GIC 6footnote 6. Special GIC Rates · %legal disclaimer * on a 1 year term · %legal disclaimer * on a 1 year term · %legal disclaimer * on a 2 year term · %legal. Guaranteed Investment Certificates (GICs) ; % · 1-year CIBC Variable Rate GIC · % · about the CIBC Variable Rate GIC. ; % · 1-year CIBC Bonus Rate GIC. Currently the most competitive one-year GIC rate is %, offered by Saven Financial, Oaken Financial, WealthOne Bank of Canada, MAXA Financial and ICICI Bank. GIC short term · 1 year GIC. Redeemable after 30 days without penalty. Canadian banks. %. ,$+ · 2 month GIC. Non-redeemable. Canadian banks. %. There is no minimum interest rate guarantee and actual interest rate could be as low as 0% over the 2-year term and 3-year term. Minimum investment is $ Featured GIC Rates · % · % · %** up to % · Stay safe and secure · Customize your solution · Save on taxes. Each year one GIC will mature and you can reinvest the money into a new 5 year GIC: If interest rates increase, you can reinvest at a higher interest rate. If. Our featured GICs and their rates ; %. 12 ; %. 18 ; %. 24 ; %. %. 2-Year BMO GIC 6footnote 6. An ideal investment that provides guaranteed interest for a short-term savings goal. · %. 12 Month BMO GIC 6footnote 6. Special GIC Rates · %legal disclaimer * on a 1 year term · %legal disclaimer * on a 1 year term · %legal disclaimer * on a 2 year term · %legal. Guaranteed Investment Certificates (GICs) ; % · 1-year CIBC Variable Rate GIC · % · about the CIBC Variable Rate GIC. ; % · 1-year CIBC Bonus Rate GIC.

Best 3-Year GIC Rates Currently Available in Canada*. Oaken Financial, Achieva Financial, MAXA Financial, Outlook Financial, Saven Financial – % · Best Bridgewater Bank offers exceptional GIC rates Canada-wide, including CDIC eligible coverage. Invest in a Bridgewater Bank Guaranteed Investment Certificate. Current GIC/Term Deposit Rates. Non-registered, Registered, Tax Free Savings, US Canada M5R 2A5. Toll Free: Email: [email protected] Current rates · 1 year % · 2 year % · 3 year % · 4 year % · 5 year %. Related Content. Accounts home · Account rates · Use Your Money. Fixed 1Y – 5Y Term GICs. 1 Year. 2 Year. 3 Year. 4 Year. 5 Year. Royal Bank of Canada. %. %. %. %. %. Royal Bank Mortgage Corp. Our featured GICG I C rates and products · BMO Growth GICG I C. Up to 20% Earn up to 20%, footnote 1 at the end of four years. Grow your return potential, not. Let's help you compare the best GIC rates · Sponsored. EQ Bank. %. 1-year Non-registered. get this rate · Sponsored. MCAN Wealth. %. 5 Year Non-Registered. Fixed long-term GICs ; 1-year, %, % ; 2-year, %, % ; 3-year, %, % ; 4-year, %, % ; 5-year, %, %. Guaranteed Investment Certificates (GIC) & Term Deposit: GICs and Term Deposits are the most secure investments for short, medium and long term savings. Guaranteed Investments (GIC) · 1 Year Guaranteed Investment, %. 1½ Year Guaranteed Investment, % · 2 Year Guaranteed Investment, % · 3 Year Guaranteed. Rate: 3% per annum on a 1 year term · Terms: days, 1 year and 3 years · Minimum investment: $ · Cashability: Cashable at prescribed early cashing rates. GICs are CDIC eligible deposit products and are CDIC-insured up to a maximum of $, including both principal and interest combined for both Canadian. What are the Highest GIC Rates available in the market? · The Highest 3-month GIC Rate is %, offered by · The Highest 6-month GIC Rate is %, offered by. Our GIC rates ; 1 Year, , ; 18 Months, , ; 2 Years, , ; 3 Years, , Guaranteed Investment Certificate (GIC) Rates ; %. 1 year ; %. 18 months ; %. 2 years ; %. 3 years ; %. 4 years. Guaranteed Investment Certificates Make bank, guaranteed. Lock in up to % (Footnote). · Don't miss our featured GIC rates · How much growth are we really. Let's help you compare the best GIC rates · Sponsored. EQ Bank. %. 1-year Non-registered. get this rate · Sponsored. MCAN Wealth. %. 5 Year Non-Registered. The current CIBC Prime Rate is %. If funds are withdrawn or transferred within 29 days of purchase, no interest will be paid on those funds. Where the. Get the best rates for Non- Redeemable, Redeemable & Cashable GIC · % · %. Non-Registered GICs (Term Deposits) ; Non-Redeemable GICYear, Rate%, Get This Rate ; Non-Redeemable GICYear, Rate%, Get This Rate ; Non-.

What Should Your Credit Card Usage Be

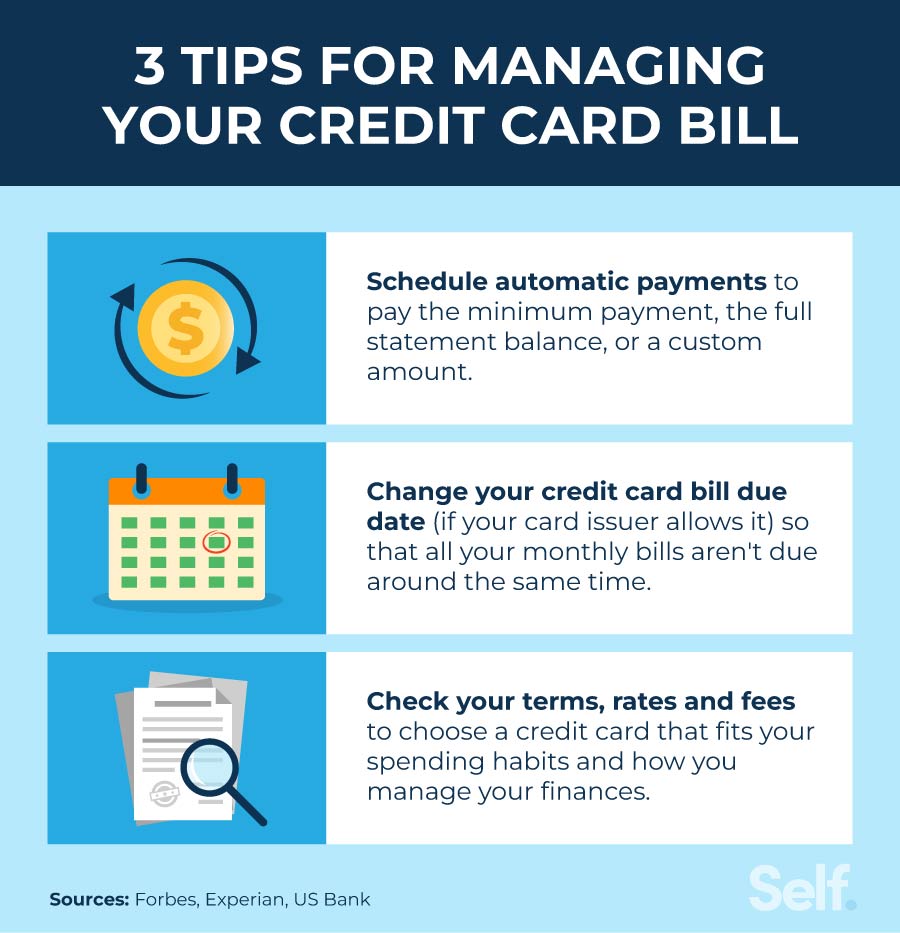

You must not pass up the chance when banks offer to raise the credit card limit. It is recommended to not use more than 30% to 40% of the credit card limit. Try to keep your credit utilization rate below 30 percent. That means if you have a credit card with a $10, limit, the balance should be less than $3, If you want to improve your credit utilization, first pay down your debts to at least under 30% of your available credit. Other ways include utilizing more. How to Build or Improve Credit with a Credit Card · Apply For a Credit Card That Matches Your Spending Goals · Understand How Much of Your Available Credit You'. You must pay your entire statement balance (including all promotional purchase and balance transfer balances) by the due date each month to avoid being charged. Credit reporting agencies recommend keeping your ratio at 30% or below. Higher ratios can hurt your credit, since credit utilization accounts for 30% of your. There's not a “too low” for an individual card, although it's reported that your total utilization should be at least 1% periodically to show. Philp adds that most experts suggest keeping your credit utilization—the size of your balance on your cards versus your total available credit—at 30% or less. Be sure to monitor how much you spend on each credit card and the payment due dates so that you don't go into credit card debt, pay high interest rates or get. You must not pass up the chance when banks offer to raise the credit card limit. It is recommended to not use more than 30% to 40% of the credit card limit. Try to keep your credit utilization rate below 30 percent. That means if you have a credit card with a $10, limit, the balance should be less than $3, If you want to improve your credit utilization, first pay down your debts to at least under 30% of your available credit. Other ways include utilizing more. How to Build or Improve Credit with a Credit Card · Apply For a Credit Card That Matches Your Spending Goals · Understand How Much of Your Available Credit You'. You must pay your entire statement balance (including all promotional purchase and balance transfer balances) by the due date each month to avoid being charged. Credit reporting agencies recommend keeping your ratio at 30% or below. Higher ratios can hurt your credit, since credit utilization accounts for 30% of your. There's not a “too low” for an individual card, although it's reported that your total utilization should be at least 1% periodically to show. Philp adds that most experts suggest keeping your credit utilization—the size of your balance on your cards versus your total available credit—at 30% or less. Be sure to monitor how much you spend on each credit card and the payment due dates so that you don't go into credit card debt, pay high interest rates or get.

Your FICO score does not consider your credit limit by itself. Instead, the FICO score considers your credit limit when determining your credit utilization. Credit card utilisation refers to the percentage of a borrower's total available credit that is being utilised. 4. Ask for a higher credit limit Increasing your credit limit immediately decreases your credit utilization. For example, if you increased your credit card's. A good starting point for a budget is an amount less than 30% of your credit card limit. Maintaining this level, or lower, benefits your credit score. Learn. No matter where your credit utilization rate stacks up against the average, know that the magic to a healthy utilization ratio is maintaining a low credit card. Your credit card must be confirmed; if it is not confirmed, no money will transfer to cover the overdraft. Once your credit card has been confirmed, please. Paying your credit card balance on time and in full is best for your credit, and if you carry a balance, it should be no more than 30% of your limit. Just because you have a limit doesn't mean you should use it all. · Ask for an increase on your credit card limit · Pay off a portion before your statement cycle. Maxing out a credit card doesn't just mean running up a high balance. It means running up the HIGHEST balance allowed on your card. Leaving zero credit. Used responsibly, a credit card can be a very helpful financial tool. Making consistent, on-time payments can boost your credit rating, and some cards offer. Credit reporting agencies recommend keeping your ratio at 30% or below. Higher ratios can hurt your credit, since credit utilization accounts for 30% of your. Where credit scores are concerned, a high credit utilization ratio will impair your credit score.2 It may not seem fair—if you have just one card and pay it off. A credit limit is the highest amount you're able to put on your credit card before you make any repayments. Your limit is determined by a few different factors. Some of the benefits of a standard credit card include convenience, security, the ability to extend payments over time, low interest on balance transfers, cash. For example, if you have a $1, balance on a single credit card with a $4, credit limit, your utilization rate is 25%. According to the Consumer Financial. Your best strategy is to use your credit cards and pay off the bill in full each month, so you keep your overall debt-to-credit limit ratio low. 7. Fact: Having. However, your FICO Score takes into consideration something called a Credit Utilization Ratio. This ratio looks at your total used credit in relation to your. However, the standard rule, and what you'll hear most financial coaches tell you, is that you should keep your credit utilization ratio below 30% whenever. Try to keep balances below 25% of your available credit limit. How a credit card could damage your credit score. To.

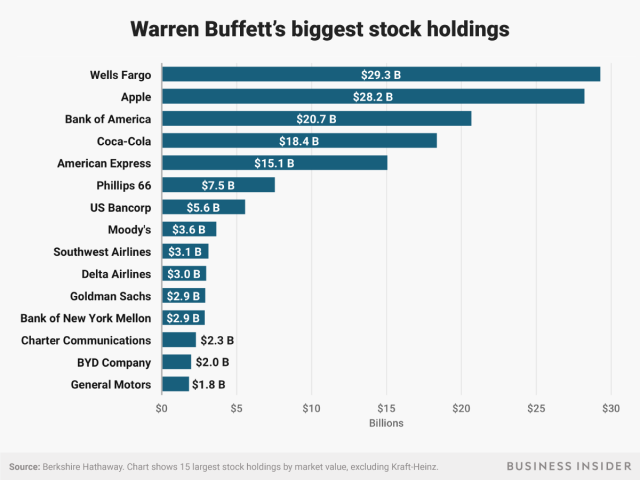

Warren Buffett Stock List 2021

Increase US$ trillion () · Increase US$ billion () · Warren Buffett (% of votes, % of shares) · , () · See List of. Warren Buffett's Berkshire Hathaway Is Selling Bank of America Stock Again Created with Highcharts Cash Flow 0 $80B. Top 5 Positions in Warren Buffett's Portfolio · 1. Apple · 2. Bank of America · 3. American Express · 4. Coca-Cola · 5. Chevron. investment portfolio of stocks and for the companies he acquired in full. Current Warren Buffett Portfolio Q3 Update · Portfolio, Warren Buffett. Berkshire Hathaway Inc's top holdings are Apple Inc. (US:AAPL), Bank of America Corporation (US:BAC), American Express Company (US:AXP), The Coca-Cola. Oracle's Berkshire sells Barrick Gold and Pfizer, and expands Chevron stake despite his green leanings. January 5, Index-Besotted Institutions Miss Out on. Berkshire Hathaway, run by legendary billionaire investor Warren Buffett, is a holding company engaged in a number of diverse business activities. Read more post on Warren Buffett's investments ; Warren Buffett's Berkshire Hathaway buys Kroger Inc and Aon Plc, sells GM and Merck & Co August 17, Letters from Warren E. Buffett Regarding Pledges to Make Gifts of Berkshire Stock · Facts Regarding Berkshire's Investments in Activision Common Stock. Increase US$ trillion () · Increase US$ billion () · Warren Buffett (% of votes, % of shares) · , () · See List of. Warren Buffett's Berkshire Hathaway Is Selling Bank of America Stock Again Created with Highcharts Cash Flow 0 $80B. Top 5 Positions in Warren Buffett's Portfolio · 1. Apple · 2. Bank of America · 3. American Express · 4. Coca-Cola · 5. Chevron. investment portfolio of stocks and for the companies he acquired in full. Current Warren Buffett Portfolio Q3 Update · Portfolio, Warren Buffett. Berkshire Hathaway Inc's top holdings are Apple Inc. (US:AAPL), Bank of America Corporation (US:BAC), American Express Company (US:AXP), The Coca-Cola. Oracle's Berkshire sells Barrick Gold and Pfizer, and expands Chevron stake despite his green leanings. January 5, Index-Besotted Institutions Miss Out on. Berkshire Hathaway, run by legendary billionaire investor Warren Buffett, is a holding company engaged in a number of diverse business activities. Read more post on Warren Buffett's investments ; Warren Buffett's Berkshire Hathaway buys Kroger Inc and Aon Plc, sells GM and Merck & Co August 17, Letters from Warren E. Buffett Regarding Pledges to Make Gifts of Berkshire Stock · Facts Regarding Berkshire's Investments in Activision Common Stock.

Videos dedicated to the craft of legendary investors Warren Buffett & Charlie Munger in which I share what I learned, apply, and keep studying from the GOATs. Here, we provide a list of our favorite Warren Buffett quotes to inspire your long-term investment goals. JEEVA RAMASWAMY is a managing partner of GJ Investment Funds, an investment fund modeled after the original 's Buffett partnership. Since its inception in. These are the publicly traded US stocks owned by Warren Buffett's holding company Berkshire Hathaway, as reported to the Securities and Exchange Commission. Berkshire Hathaway Inc has disclosed 41 total holdings in their latest SEC filings. Portfolio manager(s) are listed as Warren Buffett. Berkshire Hathaway Holdings · Apple Inc · American Express Co. · Bank Of America Corp. · Coca-Cola Co · Chevron Corp. · Occidental Petroleum Corp. · Moody`s Corp. Bank of America accounts for over 11% of Berkshire Hathaway's portfolio, making it the company's second-largest investment. Warren Edward Buffett is an American businessman, investor, and philanthropist who currently serves as the chairman and CEO of Berkshire Hathaway. Srinath Rajanna. Group Executive Vice President, Finance at DP Published Feb 27, + Follow. I am a big follower of Warren Buffet's value investing. Overview. Buffett is the chairman and largest shareholder of Berkshire Hathaway, the investment group that's delivered a % compounded annual gain in market. · · For shareholders and others who are interested, a book that compiles the full unedited versions of each of Warren Buffett's letters to. As a trustee from – , Warren Buffett worked along with Bill Gates Warren Buffett's Best Investment. Warren Buffett's gift to our foundation. Berkshire Hathaway is one of the most coveted companies and stocks in the world, thanks to the investing prowess of Warren Buffett. Warren Buffett Portfolio: an investment of 1$, since September , now would be worth $, with a total return of % (% annualized). While Buffett was bullish on BOA, his selloff of other financial stocks -- which had left so many investors baffled in -- continued into the first quarter. Real Time Net Worth · Known as the "Oracle of Omaha," Warren Buffett is one of the most successful investors of all time. · Buffett runs Berkshire Hathaway, which. Warren Buffett started to build up the position in Kroger in Q4 and continued to invest until Q2 Since then they sold Million shares. The stake. Bestselling authors Mary Buffett and David Clark examine seventeen companies that Warren Buffett has bought for himself and for his holding company, Berkshire. JEEVA RAMASWAMY is a managing partner of GJ Investment Funds, an investment fund modeled after the original 's Buffett partnership. Since its inception in. 13F Portfolio Filings ; Most recent 13F: Q2 ; Notable people: Warren Buffett ; Location: Omaha, NE ; CIK: ; All SEC filings: View on tdmcourse.ru

What Time Does Moneygram Close At Walmart Today

Trust MoneyGram, Ria & Western Union. More ways to send. Choose cash pickup, bank deposit, mobile wallet & more. are the hours for Moneygram · and on Sunday the hours · at Walmart on Orange County, · in-store at Potato Rd, · Walmart Supercenter is directly at · at your. Quickly and reliably transfer money online and pickup anywhere in the US and inside Walmart stores, or internationally wherever you see the MoneyGram sign. Processing fees may apply. MoneyGram Sender Code: Check FreePay At most Wal-Mart locations. Western Union Biller Code: ACA GA. What would you like to do today? With the Customer Portal, you can manage your account 24/7, make payments, and schedule AutoPay. A one-time guest payment. Find listings related to 24 Hour Moneygram At Walmart in Norwalk on tdmcourse.ru See reviews, photos, directions, phone numbers and more. How long does it take to receive the money? Many transactions arrive in minutes, but timing of funds availability depends on payment & receiving methods. GET money orders, SEND money transfers and PAY bills at this MoneyGram® location inside WAL-MART - # on NW 27TH AVE in Miami Gardens, FL. You can choose between minute or 4-hour domestic transfers as well as same-day international money transfers, which are subject to agent operating hours and. Trust MoneyGram, Ria & Western Union. More ways to send. Choose cash pickup, bank deposit, mobile wallet & more. are the hours for Moneygram · and on Sunday the hours · at Walmart on Orange County, · in-store at Potato Rd, · Walmart Supercenter is directly at · at your. Quickly and reliably transfer money online and pickup anywhere in the US and inside Walmart stores, or internationally wherever you see the MoneyGram sign. Processing fees may apply. MoneyGram Sender Code: Check FreePay At most Wal-Mart locations. Western Union Biller Code: ACA GA. What would you like to do today? With the Customer Portal, you can manage your account 24/7, make payments, and schedule AutoPay. A one-time guest payment. Find listings related to 24 Hour Moneygram At Walmart in Norwalk on tdmcourse.ru See reviews, photos, directions, phone numbers and more. How long does it take to receive the money? Many transactions arrive in minutes, but timing of funds availability depends on payment & receiving methods. GET money orders, SEND money transfers and PAY bills at this MoneyGram® location inside WAL-MART - # on NW 27TH AVE in Miami Gardens, FL. You can choose between minute or 4-hour domestic transfers as well as same-day international money transfers, which are subject to agent operating hours and.

Did you know you can easily pay bills at Walmart with MoneyGram? Learn what Get peace of mind knowing your payment is there and on time. To make. I went to Walmart for refund. And on my bank statement it show MoneyGram. Store manager not there, whoever in store charge kick me out of store. You can pick up your cash at any Walmart store in the US or Puerto Rico, not to mention the more than , MoneyGram locations around the world. +. GET money orders, SEND money transfers and PAY bills at this MoneyGram® location inside WAL-MART - # on KEEAUMOKU ST in Honolulu, HI, Hours. Monday AM - PM. Tuesday AM -. Time. Payments made after that time will be credited the next day If you would like to make a payment with MoneyGram use the convenient link below. How do I pay a bill at a Walmart powered by MoneyGram agent location? You can change your mind and revisit your preferences at any time by accessing. Easily transfer money to loved ones through Walmart. Send money from Walmart to Walmart or to any MoneyGram location for cash pickup within the U.S. or send. Find listings related to 24 Hour Moneygram At Walmart in Wyomissing on tdmcourse.ru See reviews, photos, directions, phone numbers and. Processing time: 2 business days. Low Fee Payment Options. Cash. Walmart Logo Money Transfer Services. Amscot logo tdmcourse.ru · MoneyGram logo tdmcourse.ru Check with local agents for store hours, restrictions, and closures if you need to send money using cash. We will continue to monitor updates and. With convenient operating hours from 6 am and an accessible location at Narcoossee Rd, Orlando, FL , it's easier than ever to receive the help you. Does Walmart cash money orders? Walmart will cash Western Union & MoneyGram money orders. Check cashing fees may apply. Do I need ID? For purchases over. MoneyGram Processing Times. When making a credit or debit card payment through MoneyGram, allow three business days for the payment to post to your child. You can use cash as any MoneyGram location. Walmart locations also accept payments using debit cards. Go to Rates & Fees on the MoneyGram/Walmart home page to estimate online money transfer costs and see current exchange rates. Does the receiver's name. () This walmart supercenter ranch drive they did not handle How much time does it take to learn to use this card and read all the. See how to pay your Ford Credit bill. Sign in to make a payment online & set up automatic payments. Pay by telephone, mail a check to our address, do a wire. MoneyGram app provides the speed,. Walmart Moneygram Opening Hours does Walmart open and close? location today! ajax? E26A-6FEE2-A1DD. You can pick up your cash at any Walmart store in the US or Puerto Rico, not to mention the more than , MoneyGram locations around the world. +.

Companies Like Paychex

Why Companies Choose Paychex vs. ADP. Choose Paychex to help simplify your companies like Xero, Indeed, Intuit Quickbooks and Jirav. Recognized for. Niural VS · Paychex · Choose Niural over · Paychex · Why choose Niural over competitors like · Paychex · What we're hearing from customers · Effortlessly grow your. Ready to switch payroll companies? Moving to Paychex is fast, easy, secure, and completed by our dedicated team in under 48 hours. Paychex Flex has market share of % in onboarding market. Paychex Flex competes with 56 competitor tools in onboarding category. The top alternatives for. Companies using Paychex Flex for Payroll include: Bank of America Corporation, a United States based Banking and Financial Services organisation with Paychex is a registered Independent Sales Organization of Wells Fargo Bank, N.A., Concord, CA. intentionally blank. Discover why Netchex is the Preferred Choice Over Paychex · Integrated, seamless HR technology. · Comprehensive, multifunctional tools. · Insightful and robust. Why Companies Choose Paychex vs. Intuit QuickBooks®. Choose Paychex to help companies like Xero, Indeed, Intuit Quickbooks and Jirav. Recognized for. Paychex Flex Alternatives & Competitors Top paid & free alternatives to Paychex Flex includes TallyPrime, Keka, factoHR, HRMantra. Why Companies Choose Paychex vs. ADP. Choose Paychex to help simplify your companies like Xero, Indeed, Intuit Quickbooks and Jirav. Recognized for. Niural VS · Paychex · Choose Niural over · Paychex · Why choose Niural over competitors like · Paychex · What we're hearing from customers · Effortlessly grow your. Ready to switch payroll companies? Moving to Paychex is fast, easy, secure, and completed by our dedicated team in under 48 hours. Paychex Flex has market share of % in onboarding market. Paychex Flex competes with 56 competitor tools in onboarding category. The top alternatives for. Companies using Paychex Flex for Payroll include: Bank of America Corporation, a United States based Banking and Financial Services organisation with Paychex is a registered Independent Sales Organization of Wells Fargo Bank, N.A., Concord, CA. intentionally blank. Discover why Netchex is the Preferred Choice Over Paychex · Integrated, seamless HR technology. · Comprehensive, multifunctional tools. · Insightful and robust. Why Companies Choose Paychex vs. Intuit QuickBooks®. Choose Paychex to help companies like Xero, Indeed, Intuit Quickbooks and Jirav. Recognized for. Paychex Flex Alternatives & Competitors Top paid & free alternatives to Paychex Flex includes TallyPrime, Keka, factoHR, HRMantra.

As a result, we've dug deep to unearth the best payroll software to consider when you're looking for companies like Paychex. Our top Paychex alternative? Top 7 Paychex Flex Alternatives · Square Payroll · Zoho Payroll · Paylocity · Sage Business Cloud Payroll · Gusto · HR Pearls · Gen Payroll. The full list of. I had a similar issue with Paychex. Their Have tried Paychex, ADP, and Gusto in the last 12 months with different companies. companies like Xero, Indeed, Intuit Quickbooks and Jirav. With Paychex Flex®, You'll Find Time to Focus on Strategy and Growth. Kelly Ennis of The Verve. Find the top Paychex Flex Software alternatives in Our list is fueled by product features and real user reviews and ratings. The top three of Paychex's competitors in the Payroll And Benefits category are QuickBooks Payroll with %, Sage Business Cloud Payroll with %. Top 10 Paychex Flex alternatives are PayScale, Cornerstone Performance, SumTotal Talent, CompTrak, Paycom, SAP SuccessFactors, Paycor, Deel, Payfactors and. Best Paychex Flex Alternatives for Enterprises · Infor Human Resources · Vibe HCM · Zoho People · Oracle Fusion Cloud HCM · Cornerstone OnDemand · ELMO Software. Many companies quickly outgrow Paychex because it has only basic functionalities and limited HR capabilities. Rippling supports businesses of all sizes and. Why Companies Choose Paychex vs. Gusto. Choose Paychex to help simplify your companies like Xero, Indeed, Intuit Quickbooks and Jirav. Recognized for. Paychex competitors are ADP, Broadridge, Fiserv, and more. Learn more about Paychex's competitors and alternatives by exploring information about those. Paychex Ranks 4th in Overall Culture Score · 1st. ADP's Logo. ADP. 83 / · 2nd. Fiserv's Logo. Fiserv. 79 / · 3rd. Booz Allen Hamilton's Logo. Booz Allen. Paychex's Profile, Revenue and Employees. Paychex is a New York-based HR consulting firm that provides solutions such as payroll, employee onboarding. Gusto is a user-friendly payroll and HR software that competes with Paychex. It offers a range of features to streamline your HR processes and optimize your. Paychex is recommended for mid-size businesses in the healthcare, non profit, and construction industries that need easy and efficient payroll, tax filing, and. Why Companies Choose Paychex vs. Paycor. Choose Paychex to help simplify companies like Xero, Indeed, Intuit Quickbooks and Jirav. Recognized for. Paychex's main competitors include Fiserv, SkypeTime, Civica, Alight, Xero, ADP, BenefitMall, Paycom Software, Paylocity, Paycor and Gusto. Paychex Flex Alternatives and Competitors. Best Alternatives for Paychex Flex are BambooHR, Orange HRM, Zimyo, PeopleSoft, & Paylocity. Looking for alternatives to Paychex Flex? Find out how Paychex Flex stacks up against its competitors with real user reviews, pricing information. I had a similar issue with Paychex. Their Have tried Paychex, ADP, and Gusto in the last 12 months with different companies.

Best Auto Loan Rates Florida

Current TFCU accounts must be in good-standing, not have any type of restrictions, and TFCU loans paid-to-date. **Up to 84 month rate and term available for new. Vehicle loans for whatever drives you · New & Used Car Loans · Auto Loan Refinance · Recreational Loans · Auto Loan Express Drafts. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. New Auto Loan Rates · 48 months or less · % – % · $ – $ · 60 months · % – % · $ – $ · 66 months · % – %. Auto Loan Rates (new & used) ; %, months, % ; %, months, % ; %, months ($18, minimum), % ; %, Used Vehicle, Up to 84 months, % to % ; Classic Vehicle, Up to 60 months, % to % ; New and Used Motorcycle, Up to 72 months, % to %. Auto Loan Rates ; New | Model Year and newer · % APR · % APR ; Used | Model Year through · % APR · % APR ; Older Used | Model Year Best auto loan rates in West Palm Beach, Florida ; Connexus Credit Union. %. It's easy to join Connexus and save. Learn how to access our Auto Loan perks and. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. Current TFCU accounts must be in good-standing, not have any type of restrictions, and TFCU loans paid-to-date. **Up to 84 month rate and term available for new. Vehicle loans for whatever drives you · New & Used Car Loans · Auto Loan Refinance · Recreational Loans · Auto Loan Express Drafts. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. New Auto Loan Rates · 48 months or less · % – % · $ – $ · 60 months · % – % · $ – $ · 66 months · % – %. Auto Loan Rates (new & used) ; %, months, % ; %, months, % ; %, months ($18, minimum), % ; %, Used Vehicle, Up to 84 months, % to % ; Classic Vehicle, Up to 60 months, % to % ; New and Used Motorcycle, Up to 72 months, % to %. Auto Loan Rates ; New | Model Year and newer · % APR · % APR ; Used | Model Year through · % APR · % APR ; Older Used | Model Year Best auto loan rates in West Palm Beach, Florida ; Connexus Credit Union. %. It's easy to join Connexus and save. Learn how to access our Auto Loan perks and. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision.

Compare new and used auto loan rates, estimate your costs with our car loan calculator, and get pre-approved so that you can shop with confidence. A good interest rate on a new or used car is typically the lowest rate you can get, as that means that you pay less in interest over time and your monthly car. Reduce the hassle of buying a car with the best auto loans in Tampa. Take advantage of our special auto loan promotion with rates as low as % APR* on new, used, or refinance auto loans. SCCU offers easy, low rate auto loans for new car loans, used car loans, and auto refinance with fast approvals and convenient loan application process. Compare auto loan rates in September ; Carputty, Starting at %, 63 Months, $25,$,, Bankrate Award winner for best auto loan for used car. APR=Annual Percentage Rate and is based on loan term, credit and collateral qualifications. On a loan amount of $15, with an APR of % and a month term. loan, we can help you finance your next ride. We'll even work with you if your credit score is not the best. Apply Now Motorcycles, Boats and RVs. Red car. get a competitive rate on an auto loan! Members will experience a unique loan program at FWCCU when it comes to obtaining the best loan rate in the market. Rates as of Sep 05, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas Often, to promote auto sales, car manufacturers offer good financing deals via dealers. Get the Best Car Loan with Auto Loan Rates That Fit Your Needs. When you Kentucky Ave Lakeland FL Insured by NCUA. Equal Housing Opportunity. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. Current TFCU accounts must be in good-standing, not have any type of restrictions, and TFCU loans paid-to-date. **Up to 84 month rate and term available for new. At Keys FCU, we take pride in offering our members some of the most competitive and attractive auto loan rates available in the Sunshine State. Use your calculation to find a good car loan. With the loan amount and term you already specified, add a couple more details to see lenders that might be a fit. Get the best auto loan rate when you purchase or finance with CAMPUS. Easy Also of Interest. Credit Union Loan Payment in Florida · Personal Loans. For a month loan: · The monthly payment comes out to be $ with an interest rate of percent. · With the added interest payments, you'll be paying a. Dade County Federal Credit Union has low rates on Auto Loans. Apply Main Branch. NW Avenue Miami, FL Lobby Hours: Mon - Wed,

Invest In Gold Uk

Invest in gold through VanEck ETFs that can provide exposure to gold's store of value and potential protection against inflation. Risk of capital loss. Gold Bank is an investment gold company established over 30 years with headquarters in West London. 33, KG gold bought from sellers. k. Safely delivered. Buy gold from one of the oldest gold bullion dealers in the UK - Trusted to buy & sell gold for over 40 years! Visit our gold shop in London or buy gold online. When you buy gold bars online you are investing in a physical asset that can be held outside the formal banking and financial sectors. Gold is widely seen as a. Gold can be traded in a very similar way to other assets, including stocks, forex and crypto. Multi-asset brokerage accounts allow investors to hold a position. Physical gold ETFs allow investors to gain exposure to gold as an asset class through the convenience of a modern investment product. Customers who buy shares. Buy & sell gold at wholesale market prices for a better deal than UK coin stores. Discover why vaulted gold is the easiest, safest & cheapest way to buy >>. You can more safely invest in gold through exchange-traded funds (ETFs), stocks in gold mining firms and associated companies, and physical coins or bullion Gold has reached new all-time highs in the UK repeatedly since and into , as the economic backdrop drives further demand for this safe haven metal. Invest in gold through VanEck ETFs that can provide exposure to gold's store of value and potential protection against inflation. Risk of capital loss. Gold Bank is an investment gold company established over 30 years with headquarters in West London. 33, KG gold bought from sellers. k. Safely delivered. Buy gold from one of the oldest gold bullion dealers in the UK - Trusted to buy & sell gold for over 40 years! Visit our gold shop in London or buy gold online. When you buy gold bars online you are investing in a physical asset that can be held outside the formal banking and financial sectors. Gold is widely seen as a. Gold can be traded in a very similar way to other assets, including stocks, forex and crypto. Multi-asset brokerage accounts allow investors to hold a position. Physical gold ETFs allow investors to gain exposure to gold as an asset class through the convenience of a modern investment product. Customers who buy shares. Buy & sell gold at wholesale market prices for a better deal than UK coin stores. Discover why vaulted gold is the easiest, safest & cheapest way to buy >>. You can more safely invest in gold through exchange-traded funds (ETFs), stocks in gold mining firms and associated companies, and physical coins or bullion Gold has reached new all-time highs in the UK repeatedly since and into , as the economic backdrop drives further demand for this safe haven metal.

All official UK gold coins minted by The Royal Mint are capital gains tax exempt, making their British coins a popular investment choice across the UK. Find out about the best ways of investing in physical gold and understanding it's benefits. Gold trading advice from a UK based specialist - Gold Investments. UK minted coins can be completely tax free (including capital gains tax) for UK residents, but they cannot be held in a pension. Gold bars of a minimum purity. Gold Bullion Investment Bundle · 1oz Gold American Eagle coin · 30g Gold Chinese Panda coin · 1oz Gold British Britannia coin · 1oz Gold SA Krugerrand coin · 1oz. You can invest in gold without physically owning it. One way to invest in gold without physically owning it is to opt for a specialist fund, investment trust. Purchasing gold ETFs can offer flexibility and liquidity. 3. Stocks in Gold Mining. Through stock in gold mining businesses, investors can potentially become. If you have decided that gold is a good investment, then gold bullion is the best way to go. Also read: Where to buy gold bars in UK? Is gold bullion a good. tdmcourse.ru is the home of gold and silver bullion investment and vaulting. We offer UK investors the opportunity to buy gold bullion online and place it in. Top 5 Gold Investments · United Kingdom · The Royal Mint · VAT free and CGT exempt · grams · (24 carat) · United Kingdom · The Royal Mint · VAT free and. You can trade or invest in gold by buying and selling spot gold, gold futures, gold options, or gold stocks and ETFs. The best choice for most UK investors. Completely tax-free investment, with no ISA-style limits. Our gold coins are fully certified. Buy Coins. Someone unsure about how much they should invest in gold may allocate just 3% of their funds to gold, but many investors will go up to 20% or beyond. It is. Buy gold bullion bars and gold coins at low premiums from our range of investment gold products, including Royal Mint coins and Swiss gold bars. Where to trade gold CFDs. One of the best places to trade gold CFDs is eToro¹ – it's easy to use, has low fees, and you can join a community of other like-. Best-selling gold coins include the British Gold Sovereign and Gold Britannia - these are popular with UK investors due to their exemption from Capital Gains. There is no such thing as investing in gold, unless you're buying shares in a gold mining or processing company. Gold does not produce anything. Top 5 Gold Investments · United Kingdom · The Royal Mint · VAT free and CGT exempt · grams · (24 carat) · United Kingdom · The Royal Mint · VAT free and. Unlock the power of investing in the timeless value of gold bullion. Our collection features brand new bars of pure fine gold, crafted by trusted LBMA. GoldCore has been helping UK investors acquire gold since when we first launched our Gold Accumulation program. From both online and our London office we. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots.

Amortization Sheet For Mortgage

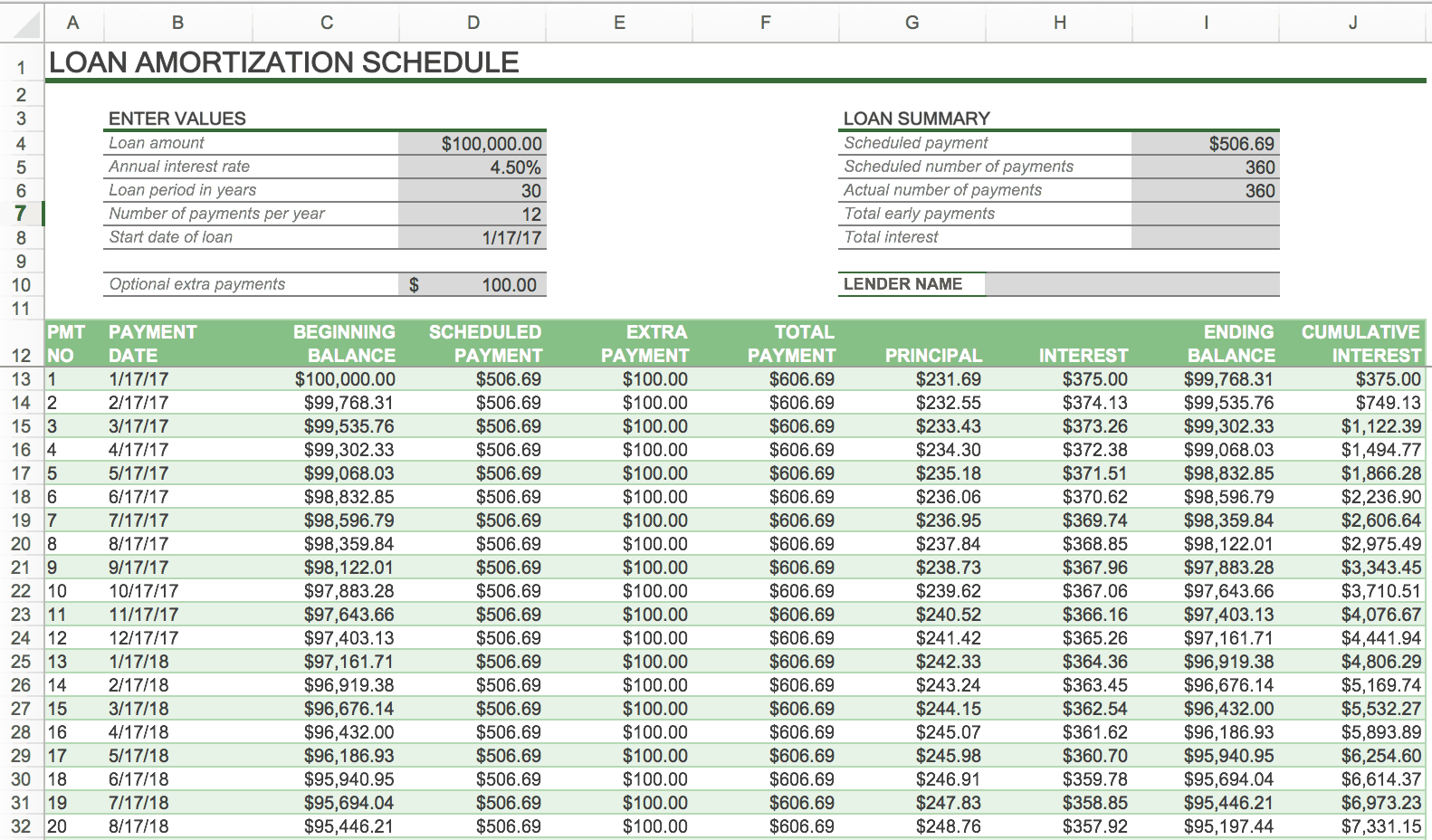

Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Click on Monitoring Amortization of a Simple Interest Loan. You can keep a permanent record by downloading the spreadsheet onto your computer and entering each. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. An amortization schedule or table gives you a visual countdown to the end of your mortgage. It's a chart that shows you how much of each payment will go toward. The amortization schedule shows how your monthly mortgage payment is split between interest and principal over the duration of the loan. Most of your payment. Simple loan calculator and amortization table blue modern simple. Customize Mortgage loan calculator yellow modern simple. Customize in Excel. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Click on Monitoring Amortization of a Simple Interest Loan. You can keep a permanent record by downloading the spreadsheet onto your computer and entering each. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. An amortization schedule or table gives you a visual countdown to the end of your mortgage. It's a chart that shows you how much of each payment will go toward. The amortization schedule shows how your monthly mortgage payment is split between interest and principal over the duration of the loan. Most of your payment. Simple loan calculator and amortization table blue modern simple. Customize Mortgage loan calculator yellow modern simple. Customize in Excel. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term.

An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan. This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. loan is a Canadian mortgage for example. Be. An amortization schedule is the loan report showing the amount paid each period and the portion allocated to principal and interest. An amortization schedule shows the progressive payoff of the loan and the amount of each payment that gets attributed to principal and interest. You can create. Select Calculate, and you'll get an amortization schedule where you can see how much of each payment reduces the loan balance, and how much goes to interest. Money Bag Logo. Amortization Calculator With Printable Schedule ; Loan amount: ; Annual interest rate (APR %): ; Loan term (years): ; Payment frequency. This spreadsheet-based calculator creates an amortization schedule for a fixed-rate loan, with optional extra payments. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Amortization Schedule ; Aug , $, $ ; Sep , $, $ ; Oct , $, $ ; Nov , $, $ The schedule shows how the ratio of principal to interest decreases throughout the life of the loan. While the borrower initially pays far more interest than. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. An amortization schedule is a table that shows the amount of interest and principal you pay each month over time. In addition, the schedule will show you the. Want to calculate mortgage payments offline? Excel Mortgage Calculator. We have offered a downloadable Windows application for calculating mortgages for many. Edit with the Sheets app. Make tweaks and share with others to edit at the same time. NO THANKSUSE THE APP. Go to Drive. Loan Amortization. Sheet1. A, B, C, D. Amortization: Months (25 Years) ; Periodic Payments of $ ; Mortgage Cost (Total Interests): $ , Amortizing Loan Calculator. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function.

1 2 3 4 5 6