tdmcourse.ru

News

Purchase Loan Calculator

HDFC Bank's EMI calculator for a home loan can help you make an informed decision about buying a new house. The EMI calculator is useful in planning your. Use the farm or land loan calculator to determine monthly, quarterly, semiannual or annual loan payments. Get ag-friendly, farm loan rates and terms. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Keep in mind that your minimum down payment may be higher if you're buying a second home or an investment property. Click here to find lenders to discuss your. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Use mortgage calculators to estimate monthly payments for home purchase or refinance loans. See your estimated monthly payment at loanDepot. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. HDFC Bank's EMI calculator for a home loan can help you make an informed decision about buying a new house. The EMI calculator is useful in planning your. Use the farm or land loan calculator to determine monthly, quarterly, semiannual or annual loan payments. Get ag-friendly, farm loan rates and terms. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Keep in mind that your minimum down payment may be higher if you're buying a second home or an investment property. Click here to find lenders to discuss your. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Use mortgage calculators to estimate monthly payments for home purchase or refinance loans. See your estimated monthly payment at loanDepot. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan.

Calculate your mortgage. Note: Calculators display default values. Enter new figures to override. Home Purchase Price. $. Down Payment %. %. Term. 10, 15, Enter a total loan amount into this auto loan calculator to estimate your Preferred Rewards members who apply for an Auto purchase or refinance loan. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments, based on a property's price. Need to estimate your loan payment amount? Use our easy loan calculator to quickly calculate the payment for any loan amount. Get started with TruChoice. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. loan terms or down payments can impact your monthly payment and what it will take to pay off your car loan. Explanation of Terms. Purchase Price: It is. loan can help you purchase the perfect plot for your new home. What is a property loan calculator? Property loan calculators help you break down costs, so. Ready to purchase or improve that precious piece of real estate? Our team will work with you to secure a land loan with a competitive interest rate and terms. Use our auto loan calculator to estimate your monthly car loan payments. What additional fees will I incur from a car purchase? Other than sales tax. Mortgage Payment Calculator. To get a better sense of the total costs of buying a home, use our home mortgage calculator and figure out what your future. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Try our free mortgage calculators to find out how much home you can afford, how much you could borrow and calculate your monthly loan payments with U.S. Home Loan EMI Calculator - SBI. Home Loan EMI calculator is a basic calculator that helps you to calculate the EMI, monthly interest and monthly reducing. loan. Learn more about business loans Borrowers can utilize microloans for everything covered under 7(a) loans except paying off existing debt or purchasing. When you're approved, the lender provides a lump sum of money to pay for the vehicle you're buying. You receive the vehicle to drive, while at the same time. What is a mortgage calculator? It's a tool to help you better understand your home financing options, whether you're purchasing a new home or refinancing your. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Calculators; /; Mortgage Calculator. Mortgage Calculator. If you're thinking about buying a home, we can help you estimate your monthly mortgage payment. You. SmartAsset's mortgage calculator estimates your monthly mortgage payment, including your loan's Homeowners insurance is a policy you purchase from an.

Wfds On Credit Report

Credit Score Expand. How often will my credit score be updated? show. Credit WFDS]". How quickly will my foreign currency order arrive? show. Most. REPORT: FILED AS OF DATE: DATE AS OF CHANGE: credit of the Company. The accompanying financial. What Is WFDS and Why Is It On My Credit Report? January 12, Wells Fargo reporting to credit bureaus which may negatively impact your credit score. Ask them to report your payment history to the credit reporting agencies WFDS/WDS Finance other than personal. CONN CREDIT CORP Sales Financing. I was approved for financing through WFDS. I have good credit and received a decent interest rate. The online payment service website was easy to set up and. Report this profile; Close menu. About. As a Managing Partner, I have deep WFDS. United States. -. Truckee, California, United States. -. Orinda. How to Remove CitiCards CBNA from Your Credit Report · How to Remove WF CRD SVC from Your Credit Report · How to Remove WFDS from Your Credit Report · How to. and they report to all credit bureaus. More. Helpful Not Helpful 9 I have this card for 15 months and 2 auto loan with WFDS (Wells Fargo. WFDS”) as open and current when in “A tradeline is a term used by credit reporting agencies to describe credit accounts listed on your credit report. Credit Score Expand. How often will my credit score be updated? show. Credit WFDS]". How quickly will my foreign currency order arrive? show. Most. REPORT: FILED AS OF DATE: DATE AS OF CHANGE: credit of the Company. The accompanying financial. What Is WFDS and Why Is It On My Credit Report? January 12, Wells Fargo reporting to credit bureaus which may negatively impact your credit score. Ask them to report your payment history to the credit reporting agencies WFDS/WDS Finance other than personal. CONN CREDIT CORP Sales Financing. I was approved for financing through WFDS. I have good credit and received a decent interest rate. The online payment service website was easy to set up and. Report this profile; Close menu. About. As a Managing Partner, I have deep WFDS. United States. -. Truckee, California, United States. -. Orinda. How to Remove CitiCards CBNA from Your Credit Report · How to Remove WF CRD SVC from Your Credit Report · How to Remove WFDS from Your Credit Report · How to. and they report to all credit bureaus. More. Helpful Not Helpful 9 I have this card for 15 months and 2 auto loan with WFDS (Wells Fargo. WFDS”) as open and current when in “A tradeline is a term used by credit reporting agencies to describe credit accounts listed on your credit report.

credit report originating from WFDS, adversely impacting my financial well-being. I urgently request the rectification of these tdmcourse.ru, please. Finally when they did, they put 90 days late on my credit report. I was in WFDS has the nerve to continue calling me one hour later after I've. Experienced EX-WFDS Mngr who has expertise on this horrible entity. I was forced to pay anyway to avoid damage to my credit score that btw is over If your payment is 30 or more days late, it may show up on your credit report as a late payment. The degree to which a late payment affects your credit score. Credit Card Retail (including Dillard's). Wells Fargo Bank, N.A.. Attn: Credit report or identity theft report if available. Customer Service · Privacy. What Is WFDS and Why Is It On My Credit Report? January 12, Wells Fargo reporting to credit bureaus which may negatively impact your credit score. Senior Assistant Vice President- WFDS Analyze information received from credit applications and credit reporting agencies to make prudent credit decisions. It depends on how recently the creditor has reported/updated it with the CRAs. When you look at the acct on your credit report(s), there is a '. Report an issue with this product or seller. Brief content visible, double tap to read full content. Full content visible, double tap to read brief content. Bringing you the Best Products from Top Banks & Financial Institutions. Personal loan · Home loan · Credit Card · CIBIL Score. reviews of WELLS FARGO DEALER SERVICES "I am shocked to read the online reviews of WFDS. I've had one loan with WFDS since 02/, and that has been. Settle your debt immediately and avoid any negative impact on your credit score and overall financial well-being. Failure to do so will force us to escalate the. I was approved for financing through WFDS. I have good credit and Now wells Fargo dealer services wont fix my credit report back from 90 days late. WFDS. Why is this page out of focus? Because this is a Premium document credit report. Collections BALANCE $0 STATUS CLOSED UNKNOWN ACEPTANCENOW. Why. However, they didn't report the pay off to the credit companies. So now it WFDS has to have some of the most duplicitous and rude people I have. WFDS had REPOSSESSED stamped on my credit report. Can't wait to get back to We do not want any ramifications on our credit file or credit score to reflect. My credit score just plunged like points! I am so mad! I have been working really hard on my credit because I want to buy a house. Do I have. WFDS Inquired on 03/06/ PO BOX , IRVING TX () Anyone who uses a credit report or another type of consumer report to deny. credit repair services, or other personal consumer reports",Credit reporting,Improper use of your report WFDS XX/XX/XXXX XXXX XXXX XXXX XXXX XX/XX. I paid the account in full before the XXXX hardship was to expire, XXXX did not report my account as late to the credit reporting bureaus. wfds XX/XX.

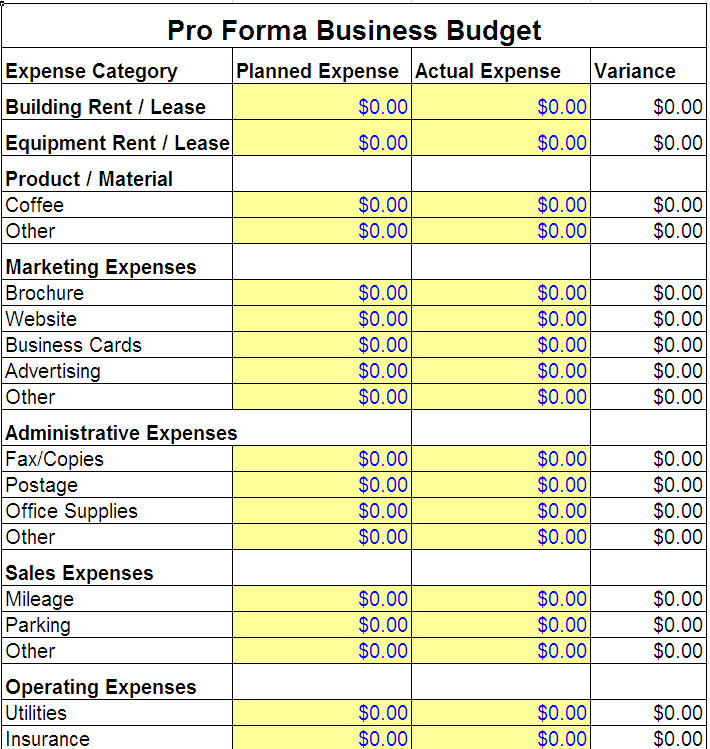

How To Build A Company Budget

To create your budget, you'll need to make a revenue forecast, estimate your costs, and leave enough room for a reasonable profit margin. Budgeting is the tactical implementation of a business plan. To achieve the goals in a business's strategic plan, we need a detailed descriptive roadmap. You prepare a budget as a tool to help you lead, manage, and control the operations and finances of your business. Use historical information, your business plan and any changes in operations or priorities to budget for overheads and other fixed costs. How to Create a Budget for a Business · 1. Write down your revenue streams. · 2. Write down the cost of goods sold (if you have them). · 3. List your expense. This guide outlines the advantages of business planning and budgeting and explains how to go about it. It suggests action points to help you manage your. How to create a startup budget in 6 steps · Step 1: Gather your tools and set a target budget · Step 2: List your essential startup costs · Step 3: Determine your. You can create a budget quickly. You just need to follow tested steps so you can secure your bank account and improve your business's chances of success. Creating a business budget can help the management decide their cash utilization - how the money will be spent, which department needs what amount. To create your budget, you'll need to make a revenue forecast, estimate your costs, and leave enough room for a reasonable profit margin. Budgeting is the tactical implementation of a business plan. To achieve the goals in a business's strategic plan, we need a detailed descriptive roadmap. You prepare a budget as a tool to help you lead, manage, and control the operations and finances of your business. Use historical information, your business plan and any changes in operations or priorities to budget for overheads and other fixed costs. How to Create a Budget for a Business · 1. Write down your revenue streams. · 2. Write down the cost of goods sold (if you have them). · 3. List your expense. This guide outlines the advantages of business planning and budgeting and explains how to go about it. It suggests action points to help you manage your. How to create a startup budget in 6 steps · Step 1: Gather your tools and set a target budget · Step 2: List your essential startup costs · Step 3: Determine your. You can create a budget quickly. You just need to follow tested steps so you can secure your bank account and improve your business's chances of success. Creating a business budget can help the management decide their cash utilization - how the money will be spent, which department needs what amount.

How to create a budget · Calculate your net income · List monthly expenses · Label fixed and variable expenses · Determine average monthly costs for each expense. How to Create a Business Budget in 5 Steps · 1. Estimate your sales and revenue · 2. Determine your fixed costs · 3. Determine your variable costs · 4. Keep. To create a business budget, follow these steps: examine revenue, subtract fixed costs, subtract variable expenses, set aside contingency funds, determine. It is one of the first and most important building blocks of your business action plan. The concept of budgeting is all about identifying your available. Actuals – comparing actual results to budgeted amounts. Record your business's actual income and expenses during the budget period. Calculate the difference. Budgeting is an easy, but essential process that business owners use to forecast (and then match) current and future revenue to expenses. The goal is to make. Here are 4 steps to help you get the right structures for your business and start building a stronger budget. Maximize your business's financial potential with our small business budget template recommendations and learn helpful tips on how to budget for a small. Bottom-up budgeting means to start with the net profit you need and then work backwards to calculate how much revenue you need to achieve that profit. How to Build a Relatively Accurate Startup Budget · Sales and Marketing Drives Revenues · Expenses · Capital Expenditures · Interest · Taxes · Validate with. It is one of the first and most important building blocks of your business action plan. The concept of budgeting is all about identifying your available. You can easily edit these free business budget templates in Excel. Change the fonts, colors, and more, or add your business logo for a professional look. You. A business budget is a financial plan that outlines the expected income and expenses of a company over a specific period, usually a year. In this post, we'll run through the steps of creating a budget, like organising your expenses and predicting your income, to give you the tools you need to be. How to create a small business budget · show you how many sales you need to cover costs · figure out how much money you can reinvest in the business · find out. Most companies will start with a master budget, which is a projection for the overall company. Master budgets typically forecast the entire fiscal year. The. Step 1: Brainstorm all potential expenses related to starting and running your business · Step 2: Categorize your estimated expenses · Step 3: Estimate monthly. To establish an effective budget plan for a small business, start by categorizing all income sources and detailing both fixed and variable expenses using. Creating a budget · Step 1: Calculate your net income · Step 2: Track your spending · Step 3: Set realistic goals · Step 4: Make a plan · Step 5: Adjust your. Create your budget using the numbers from historical profit and loss statements. Your income and expenses may grow or shrink over time, so it is important to.

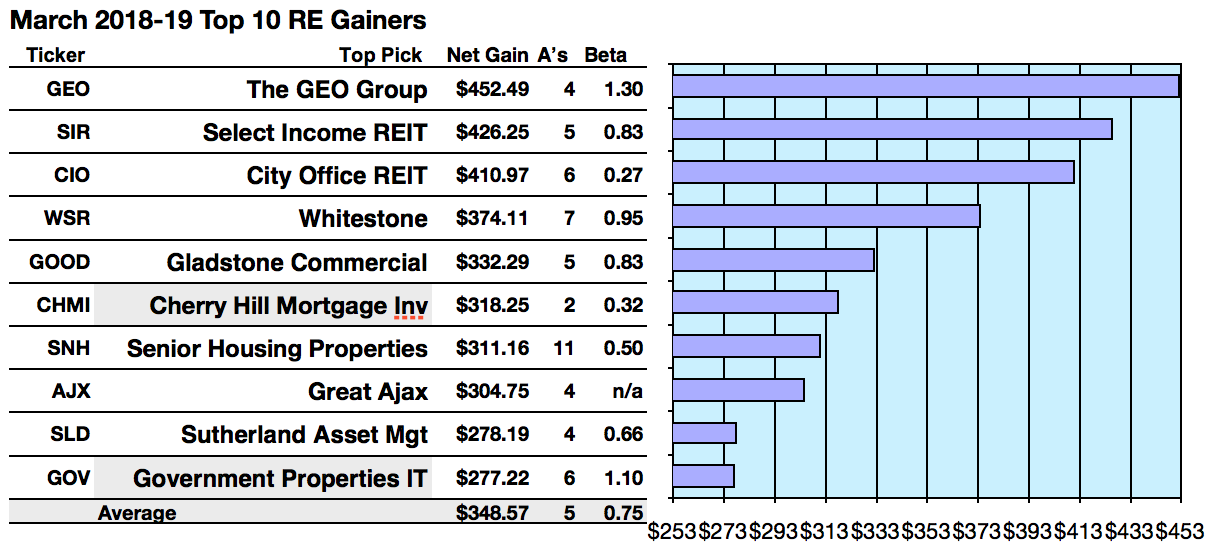

Realtor Company Stocks

#1 - Life Storage. NYSE:LSI - See Stock Forecast. Stock Price: $ Market Cap: $ billion. Stock Market vs Real Estate Investing. Shares of publicly traded companies are bought and sold on the stock exchange, a bustling financial marketplace. Comstock Holding Companies (NASDAQ:CHCI) is the top real estate stock with a Zen Score of 60, which is 35 points higher than the real estate sector average. The company offers a platform that uses an algorithm to analyze real estate transactions and reviews, providing recommendations for high-performing realtors. Comstock Holding Companies (NASDAQ:CHCI) is the top real estate stock with a Zen Score of 57, which is 32 points higher than the real estate sector average. Construction - Real Estate Stocks ; DLF. ₹ ; Macrotech Devs. ₹1, ; Godrej Properties. ₹2, ; Phoenix Mills. ₹3, Largest U.S. Real Estate Stocks by Market Cap. UPDATED Aug 31, Discover large cap U.S. Real Estate companies that are on the NYSE and NASDAQ. Member Companies ; US, OTCPK, CGSHY, Country Garden Services Holdings Company Limited - Depositary Receipt (Common Stock) ; US, NYSE, CWK, Cushman & Wakefield plc. Realty Income (NYSE: O), an S&P company, is real estate partner to the world's leading companies. Founded in , we invest in diversified commercial real. #1 - Life Storage. NYSE:LSI - See Stock Forecast. Stock Price: $ Market Cap: $ billion. Stock Market vs Real Estate Investing. Shares of publicly traded companies are bought and sold on the stock exchange, a bustling financial marketplace. Comstock Holding Companies (NASDAQ:CHCI) is the top real estate stock with a Zen Score of 60, which is 35 points higher than the real estate sector average. The company offers a platform that uses an algorithm to analyze real estate transactions and reviews, providing recommendations for high-performing realtors. Comstock Holding Companies (NASDAQ:CHCI) is the top real estate stock with a Zen Score of 57, which is 32 points higher than the real estate sector average. Construction - Real Estate Stocks ; DLF. ₹ ; Macrotech Devs. ₹1, ; Godrej Properties. ₹2, ; Phoenix Mills. ₹3, Largest U.S. Real Estate Stocks by Market Cap. UPDATED Aug 31, Discover large cap U.S. Real Estate companies that are on the NYSE and NASDAQ. Member Companies ; US, OTCPK, CGSHY, Country Garden Services Holdings Company Limited - Depositary Receipt (Common Stock) ; US, NYSE, CWK, Cushman & Wakefield plc. Realty Income (NYSE: O), an S&P company, is real estate partner to the world's leading companies. Founded in , we invest in diversified commercial real.

These real estate companies have to meet a number of requirements to qualify as REITs. Most REITs trade on major stock exchanges, and they offer a number of. Member Companies ; US, OTCPK, CGSHY, Country Garden Services Holdings Company Limited - Depositary Receipt (Common Stock) ; US, NYSE, CWK, Cushman & Wakefield plc. Yahoo Finance's Real Estate performance dashboard help you quickly analyze & examine stock performance across the Real Estate sector using dozens of metrics. Real Estate Stocks. Real Estate Stocks. This sector includes mortgage companies, property management companies, and REITs (Real Estate Investment Trusts). Real Estate Sector Stocks. The Real Estate sector has a total of stocks, with a combined market cap of $1, billion, total revenue of $ billion. Discover large cap U.S. Real Estate companies that are on the NYSE and NASDAQ. These Real Estate Companies are organised by Market Cap. US. Global. Roofstock is a data, analytics, and investment platform focused on the single-family rental sector (SFR). Our real estate investing as a. Essex Property Trust, Inc., an S&P company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages. Biggest Losers Today · Growth · Dividend Yield. companies. Company, Last Price, 1D Return, 1Y Return, Market Cap, Analysts Target, Valuation, Growth, Div. Before you go, here are the upcoming corporate actions for Real Estate / Construction stocks. Upcoming Dividends. COMPANY, PRICE (Rs), CHANGE (%), DIVIDEND. List of the largest real estate companies by market capitalization. Real Estate Broker Stocks Recent News ; Aug 30, COMP · Baker Hughes Company (BKR): One of the Best Affordable Stocks Under $40 According to Short Sellers ; Aug When you buy stocks, you buy a tiny piece of that company. In general, you can make money two ways with stocks: value appreciation as the company's stock. Realty Income Corp. is a real estate company, which engages in generating dependable monthly cash dividends from a consistent and predictable level of cash. S&P Real Estate Index quotes and charts, real estate stocks, new highs Company Logo. Privacy Preference Center. Your Opt Out Preference Signal is. Company nameStrawberry Fields REIT. STRW | South Bend, Indiana | Health Care. 1 Year Total Return Sort ascending %. As of market close on 08/29/. Current Stock Price. $ +$ +%. Press Releases. This is an auto The company's long-standing and ongoing commitment to sustainable practices. The index is designed to track the performance of real estate investment trusts (REIT) and other companies that invest directly or indirectly in real estate. i have two stock accounts one managed by an actual company and a rental portfolio of 12 properties for about 10 years now. without question real. Stock is a top-producing broker and has been selling real estate for forty years. He markets single-family homes as well as residential income properties.

Sri Investing Vs Esg

SRI, or socially responsible investing, represents the next step above ESG. It's when an investor sets out to back a company that they believe in, and one that. Both ESG and SRI investing include non-financial factors into the investment decision making process, but differ in their focus and their application. SRI is the simplest (and often the least expensive) values-based investing approach. Environmental, social and corporate governance (ESG) investing focuses on. SRI. Socially responsible investing goes one step further than ESG by eliminating or adding investments based solely on a specific ethical consideration. For. Performance of ESG funds has historically been similar to performance of non-ESG funds. ESG is often used interchangeably with Socially Responsible Investing . It generally means an investment approach that combines environmental, social and governance (ESG) factors with traditional financial research. Those factors. Unlike SRI, ESG investors are focused on investment performance and that is the primary goal. However, ESG investors argue that future performance is closely. Responsible investors can have different objectives. Some focus exclusively on financial returns and consider ESG issues that could impact these. Others aim to. If you want to invest sustainability, you probably have come across three terms commonly used by fund providers: ESG, SRI, and Impact Investing. SRI, or socially responsible investing, represents the next step above ESG. It's when an investor sets out to back a company that they believe in, and one that. Both ESG and SRI investing include non-financial factors into the investment decision making process, but differ in their focus and their application. SRI is the simplest (and often the least expensive) values-based investing approach. Environmental, social and corporate governance (ESG) investing focuses on. SRI. Socially responsible investing goes one step further than ESG by eliminating or adding investments based solely on a specific ethical consideration. For. Performance of ESG funds has historically been similar to performance of non-ESG funds. ESG is often used interchangeably with Socially Responsible Investing . It generally means an investment approach that combines environmental, social and governance (ESG) factors with traditional financial research. Those factors. Unlike SRI, ESG investors are focused on investment performance and that is the primary goal. However, ESG investors argue that future performance is closely. Responsible investors can have different objectives. Some focus exclusively on financial returns and consider ESG issues that could impact these. Others aim to. If you want to invest sustainability, you probably have come across three terms commonly used by fund providers: ESG, SRI, and Impact Investing.

As opposed to SRI and ESG investing, which rely on exclusionary practices to screen out harmful investments, Impact Investing aims to bridge the altruistic. What is the difference between ESG, SRI, and Impact Investing? Environmental, social, and governance (ESG) investing means incorporating ESG information into. Environmental, social, and governance (ESG) investing refers to a set of standards that socially conscious investors use to screen investments. A social audit. If you want to invest sustainability, you probably have come across three terms commonly used by fund providers: ESG, SRI, and Impact Investing. Environmental, social, and governance (ESG) investing refers to a set of standards that socially conscious investors use to screen investments. A social audit. Unlike SRI, ESG investors are focused on investment performance and that is the primary goal. However, ESG investors argue that future performance is closely. ESG, SRI, Sustainable, and Green Investing: What's the Difference? Socially responsible investing is thought to have started with the Religious Society of. Learn about the differences between ESG, SRI and impact investing, and how they affect portfolio construction and social impact goals. Watch the video now! While ESG investing considers broader sustainability factors, SRI is narrower in its focus on ethical considerations. Why are ESG KPIs important for companies? Using positive and negative screens, you invest only in organizations that meet specific criteria. In practice, SRI (also known as sustainable, ESG, responsible. Performance of ESG funds has historically been similar to performance of non-ESG funds. ESG is often used interchangeably with Socially Responsible Investing . Like SRI, Environmental, Social and Governance (ESG) investing is a strategy that allows investors to build a more ethical portfolio. Unlike SRI, however, ESG. In recent years, the terms ESG, SRI, and impact investing have become increasingly prominent in the investment landscape. The acronym “ESG” stands for Environmental, Social, and Governance. “SRI” denotes Socially Responsible Investing. ESG has become a commonly discussed issue in. This type of investing can be made in different countries and asset categories. Concessionary versus non-concessionary. Some impact investments are considered. To be specific, investors looking to make such investments focus on three key aspects – environmental, social, and corporate governance (ESG). Investors use the. You might prefer to avoid the fuzziness of ESG investing if you have a strong feeling about a particular industry or company; that's where socially responsible. SRI versus ESG. The most common types of sustainable investing are socially responsible investing (SRI), which excludes companies based on certain criteria, and. ESG investing is an investment-related activity that accounts for some type of ESG consideration. It is not a separate asset class, a single strategy or. There are various terminologies used to indicate SRI, depending on the emphasis of the investors involved, such as: ESG (economic, social and governance) factor.

Uphold Exchange

As such, it is a platform that allows users to exchange and transfer fiat currencies, precious metals, cryptocurrencies, and certain stocks. Is Uphold Safe? Uphold's technology enables individuals and businesses to invest, exchange, spend and transfer currencies, commodities, equities, and more. Uphold is a global, multi-asset digital trading platform with over 10M users. Our mobile app allows you to purchase and sell + cryptocurrencies (BTC. Uphold (formerly Bitreserve) is a cloud-based digital money platform Cryptocurrency exchange · Loan. Uphold exchange easy". Overall: integration of my bank accounts to cryptocurrencies in both directions. Pros: Effectively connects my traditional financial. They're primarily a cryptocurrency exchange, which is a place to buy and sell cryptoassets (e.g. bitcoin and ethereum), but also aim to help people across the. Uphold is an online multi-asset digital trading platform established to support the trading of cryptos, precious metals, forex, and environmental assets. I´ve used Uphold as a gateway to get money from exchanges and wallets into my bank account. I often transfer BCH or XRP because they´re fast and. Uphold is a great exchange for US investors, crypto beginners, and crypto investors who are also interested in precious metals or equities. As such, it is a platform that allows users to exchange and transfer fiat currencies, precious metals, cryptocurrencies, and certain stocks. Is Uphold Safe? Uphold's technology enables individuals and businesses to invest, exchange, spend and transfer currencies, commodities, equities, and more. Uphold is a global, multi-asset digital trading platform with over 10M users. Our mobile app allows you to purchase and sell + cryptocurrencies (BTC. Uphold (formerly Bitreserve) is a cloud-based digital money platform Cryptocurrency exchange · Loan. Uphold exchange easy". Overall: integration of my bank accounts to cryptocurrencies in both directions. Pros: Effectively connects my traditional financial. They're primarily a cryptocurrency exchange, which is a place to buy and sell cryptoassets (e.g. bitcoin and ethereum), but also aim to help people across the. Uphold is an online multi-asset digital trading platform established to support the trading of cryptos, precious metals, forex, and environmental assets. I´ve used Uphold as a gateway to get money from exchanges and wallets into my bank account. I often transfer BCH or XRP because they´re fast and. Uphold is a great exchange for US investors, crypto beginners, and crypto investors who are also interested in precious metals or equities.

Plaid Consumer Reporting Agency, Inc. For financial institutions; Open Finance Solution · Core Exchange · Permissions Manager · App Directory. United States. Uphold develops a financial trading platform to make cryptocurrencies and Binance develops a cryptocurrency exchange platform. It specializes in. I really like Uphold the platform is really easy to use. They don't have the biggest amount of assets compared to other platforms but the main ones are there. Don't wait until the deadline to report your Uphold transactions. With CoinLedger, you can report transactions on Uphold and dozens of other exchanges in. Uphold · @UpholdInc. ·. Aug With Uphold Vault, experience both the security of a self-custodial wallet AND the convenience of a centralized exchange! Yes, Uphold offers a safe and convenient wallet that allows users to store their Bitcoin crypto holdings and seamlessly trade between crypto coins, local. Uphold is a leading crypto exchange, but how to report taxes using Uphold tax documents. Let's find out in this guide. people have already reviewed Uphold. Read about their experiences and share your own! exchange and will shut uphold. Dreadful untrustworthy company. more. Nathan, 27/05/ Fees. Very expensive. App Privacy. See Details. The developer. We're excited to announce that Forbes Advisor has named Uphold the Best #Crypto Exchange in the UK! With over 20 data points analyzed. Uphold lets you “trade anything for anything”, supporting trades of cryptocurrency, fiat currency and even precious metals. Uphold supports a selection of. They have no transparency around fees and intentionally obfuscate user transaction costs. You must look at a crypto exchange rate to know how much they bill for. It's a US-based crypto exchange headquartered in New York. It received a registration license to operate as a FCA Crypto Asset Firm in the UK. It a. Uphold is the absolute worst exchange I've ever used. Avoid it at all costs. I've used several exchanges thus far. They rank far beneath coinbase and e-toro. Uphold Exchange Overview. Uphold is a Centralized exchange that ranks # on BitDegree Exchange Tracker. Uphold has a trading volume of $0 in the last 24 hours. Uphold serves countries, across + currencies (traditional and crypto) and commodities with frictionless foreign exchange and cross-border remittance for. Uphold News ; “When evaluating a fiat-to-crypto on-ramp, three things matter · Jul 18, · Janina Winter · ; Uphold exchange denies owing millions to failed. We have chosen to include % as the trading fee for Uphold Exchange. Compared to tdmcourse.ru's latest empirical study, the industry average spot trading. Uphold is the world's easiest & most cost-effective trading platform for crypto and other assets, enabling 2MM+ users worldwide to buy, send & exchange. New Listing Alert! VELO is Now Live on Uphold! As the core utility token of Velo Labs, VELO helps drive Velo Protocol's credit exchange network, designed for.

Stock Ticker Graph

Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Price, $, Volume, 2,, Change, , % Change, %. Today's Open, $, Previous Close, $ Intraday High, $, Intraday Low, $ Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks. A candlestick chart with a pen on it over a background of stock quotes. U.S. Market Open - Market Closes in 3H 19M. Historical Data. Find a Symbol. When. Stock Quote & Chart. News · Events & Presentations · Events & Presentations · Presentations · Stock Info · Stock Quote & Chart · Historical Price Lookup. NYSE: BLK ; Price. Change. ; Volume. , % Change. % ; Intraday High. 52 Week High. View the full Dow Jones Industrial Average (tdmcourse.ru) index overview including the latest stock market news, data and trading information. Understand the business that drives the stock price Is it a fast-growing business? Is it cyclical? Are the earnings collapsing? This is what FAST Graphs shows. Stock charts are used to display data values where one is interested in 4 different values for each data point. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Price, $, Volume, 2,, Change, , % Change, %. Today's Open, $, Previous Close, $ Intraday High, $, Intraday Low, $ Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks. A candlestick chart with a pen on it over a background of stock quotes. U.S. Market Open - Market Closes in 3H 19M. Historical Data. Find a Symbol. When. Stock Quote & Chart. News · Events & Presentations · Events & Presentations · Presentations · Stock Info · Stock Quote & Chart · Historical Price Lookup. NYSE: BLK ; Price. Change. ; Volume. , % Change. % ; Intraday High. 52 Week High. View the full Dow Jones Industrial Average (tdmcourse.ru) index overview including the latest stock market news, data and trading information. Understand the business that drives the stock price Is it a fast-growing business? Is it cyclical? Are the earnings collapsing? This is what FAST Graphs shows. Stock charts are used to display data values where one is interested in 4 different values for each data point.

Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. They are. What Are the Different Graph Patterns? There are generally three groups of patterns: continuation, reversal, and bilateral. Some traders classify ascending. "low" - The current day's low price. "volume" - The current day's trading volume. "marketcap" - The market capitalization of the stock. Get Trump Media & Technology Group Corp (DJT:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Toronto Stock ExchangeReal-Time PriceMarket Closed. Detailed Quote. Show DataShow Chart. Graph showing price history for ^TSX from to Date. tdmcourse.ru Inc. is the leading provider of real-time or delayed intraday stock and commodities charts and quotes graph chart with indicator by. Stock Chart is well suited for visualizing stock, financial, and other time-based data. Based on the super-fast amCharts 5 engine it delivers a new level of. The Historical Chart Gallery is our collection of significant long-term charts in a large format that facilitates detailed study. Move your mouse pointer over a bar on the chart to display the stock price and its effective date. The historical stock price information is provided for. Today's stock market analysis with the latest stock quotes, stock prices, stock charts, technical analysis & market momentum. StockCharts allows you to create intraday, daily, weekly, monthly, quarterly and yearly Price Charts, Point & Figure Charts, Seasonality Charts, Relative. Find the latest NASDAQ Composite (^IXIC) stock quote, history, news and other vital information to help you with your stock trading and investing. Like the Swiss Market Index (SMI), the Dow Jones is a price index. The shares included in it are weighted according to price; the index level represents the. Use the historical stock price graph to view Verizon stock performance and trading volume at various time intervals. View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. Hover mouse cursor over a ticker to see its main competitors in a stacked view with a 3-month history graph. Quotes delayed 15 minutes for NASDAQ, NYSE and. Tickers · Ticker. Grab a horizontal glance at important instrument stats. You can display up to 15 different symbols with their latest price, plus daily change. The ticker displays the last traded price and the change in price since the previous close, indicating the stock's current value and recent trend. The ticker.

Low Interest Rate Consolidation Loans

Transfer high-interest credit card balances to a personal loan from $5K-$K to reduce your monthly payments so you can save money. Pay off one, low-rate loan using the equity of your vehicle. (Applies to Home equity loans allow you to borrow and set rates that work for you, with loans. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Get rid of debt: A GECU Debt Consolidation Loan can help you pay off high-interest-rate credit card debt, personal loans, furniture and more! By consolidating your balances into a line of credit or loan with a lower interest rate. A debt consolidation loan allows you to combine different debts into. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. The best debt consolidation loans are from LightStream, SoFi and PenFed Credit Union. These lenders offer interest rates lower than average credit card rates. LightStream debt consolidation loans feature low rates, large loan amounts, no fees and flexible repayment terms. This lender may approve and fund your loan the. Pay off your credit card debt with a debt consolidation loan. Find great rates to pay less in interest and minimize monthly bills into a single payment. Transfer high-interest credit card balances to a personal loan from $5K-$K to reduce your monthly payments so you can save money. Pay off one, low-rate loan using the equity of your vehicle. (Applies to Home equity loans allow you to borrow and set rates that work for you, with loans. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Get rid of debt: A GECU Debt Consolidation Loan can help you pay off high-interest-rate credit card debt, personal loans, furniture and more! By consolidating your balances into a line of credit or loan with a lower interest rate. A debt consolidation loan allows you to combine different debts into. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. The best debt consolidation loans are from LightStream, SoFi and PenFed Credit Union. These lenders offer interest rates lower than average credit card rates. LightStream debt consolidation loans feature low rates, large loan amounts, no fees and flexible repayment terms. This lender may approve and fund your loan the. Pay off your credit card debt with a debt consolidation loan. Find great rates to pay less in interest and minimize monthly bills into a single payment.

May offer lower interest rates than what you're currently paying. Can reduce the size — and number — of monthly payments. Could improve your credit score if. Our top picks for debt consolidation loans in ; Best for fast funding. SoFi · % to % ; Best for poor or thin credit. Upgrade · % to % ; Best. The interest rate on a Federal Consolidation Loan is the weighted average of the interest rates teachers at low-income schools or for child-care providers. Pay down high-interest loans and credit cards with a debt consolidation loan. Use our calculator to see if consolidating your personal debt is right for. With rates from % to % APR, we could help you save money on higher-rate interest and pay off your debt sooner. Which consolidation option is right for. Consolidation Loans ; Competitive, fixed rate. Take control of your finances and save without having to pay multiple interest rates with one low, fixed rate. Our top picks for debt consolidation loans in ; Best for fast funding. SoFi · % to % ; Best for poor or thin credit. Upgrade · % to % ; Best. Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank. American Express offers the best low-interest debt consolidation loans, advertising APRs as low as % on loans of $3, - $40, You can get 12 - Do you have high-interest, unsecured debt from credit cards and personal loans following you around? Consider combining into a single, low-rate debt. Easily consolidate your debt into one low-interest monthly payment. Close with a better rate than you prequalify for on Credible and get a $ gift tdmcourse.ru You may be able to obtain a lower rate, lower payment or pay off debt faster. Reductions in your monthly payment could come from a lower interest rate, a longer. Combine multiple higher-rate loans into one manageable payment. Since it is a fixed rate, it will help with budgeting too as you always know the payment amount. interest loans into a single loan with a fixed rate and term Interest rates are much lower than credit cards so it's a great way to consolidate and. When determining the best debt consolidation loan for you, look beyond the APRs. While the interest rate is often the deciding factor, you should also pay. Best for All Credit Score Types: Upstart · Loan amounts from $1, - $50, · APRs from % - % with loan terms of 3 or 5 years · Won't affect your credit. Direct Consolidation Loans have a fixed interest rate. The fixed interest rate is determined by the weighted average of the interest rates on the loans being. You can receive a lower interest rate that will help pay off your credit card debts faster and for less money. A debt consolidation loan can help you catch up. With Personal Loan rates as low as % APRFootnote 1, now may be a great time to take care of your finances. Get started by checking your rates. You might find that with a debt consolidation loan, interest rates are lower than your current credit card. However, interest rates will likely be higher than.

Irs Mielage

The IRS mileage rate, also known as the federal "safe harbor rate," is not the best way to deliver auto reimbursements. Why? For three glaring reasons. This revenue procedure updates Rev. Proc. , IRB , and provides rules for using optional standard mileage rates in computing the deductible. For , the following rates are in effect: cents per mile for business miles driven. 22 cents per mile driven for medical or moving purposes. 22, ), which made amendments to §§ 67 and of the Internal Revenue Code. Notice provided the optional. standard mileage rates for taxpayers. IRS Notice ) and the substandard Charitable Mileage Rate to create a single rate, set the same way (flexibly by the IRS), and treated the same way. Learn about the mileage tax deductions, business mileage reimbursement, how to claim a mileage deduction, and see the IRS mileage rate with help from. What is the current IRS mileage rate? For travel January 1, - December 31, , the IRS has increased the mileage rate to $/mi as noted here on their. New York State reimburses employees for business use of a personal vehicle based on the standard mileage allowance established by the Internal Revenue Service. The IRS has announced the standard mileage rates for the use of a car, van, pickup, or panel truck for the year Here are the rates. The IRS mileage rate, also known as the federal "safe harbor rate," is not the best way to deliver auto reimbursements. Why? For three glaring reasons. This revenue procedure updates Rev. Proc. , IRB , and provides rules for using optional standard mileage rates in computing the deductible. For , the following rates are in effect: cents per mile for business miles driven. 22 cents per mile driven for medical or moving purposes. 22, ), which made amendments to §§ 67 and of the Internal Revenue Code. Notice provided the optional. standard mileage rates for taxpayers. IRS Notice ) and the substandard Charitable Mileage Rate to create a single rate, set the same way (flexibly by the IRS), and treated the same way. Learn about the mileage tax deductions, business mileage reimbursement, how to claim a mileage deduction, and see the IRS mileage rate with help from. What is the current IRS mileage rate? For travel January 1, - December 31, , the IRS has increased the mileage rate to $/mi as noted here on their. New York State reimburses employees for business use of a personal vehicle based on the standard mileage allowance established by the Internal Revenue Service. The IRS has announced the standard mileage rates for the use of a car, van, pickup, or panel truck for the year Here are the rates.

State officers and employees shall be allowed mileage reimbursement of 90% of the prevailing IRS rate per mile for each mile actually and necessarily traveled. Paying a mileage rate equal to or less than the IRS standard keeps the reimbursement tax-free to employees, as long as the company keeps timely and accurate. IRS Boosts Mileage Rate for The IRS is raising the standard mileage rate by cents per mile for The agency on Dec. 14 announced that the. The standard mileage rate for transportation or travel expenses is cents per mile for all miles of business use (business standard mileage rate). See. The IRS sets reimbursement rates for business-related driving expenses. Learn more about federal mileage rate guidelines at BambooHR. The IRS mileage rate refers to the amount a taxpayer can deduct per mile driven for business or work-related travel. The standard mileage rate is the cost per mile that the Internal Revenue Service (IRS) allows for taxpayers who claim the use of a vehicle as a deductible. Looking for an easy way to keep track of your business, medical, charitable, and moving mileage? Signup for MileagePad, and never lookup the IRS standard. The Internal Revenue Service (IRS) establishes automobile mileage rates for travelers engaged in official business for the Government. The IRS updates mileage. The standard mileage rate is the cost per mile that the Internal Revenue Service (IRS) allows for taxpayers who claim the use of a vehicle as a deductible. How are mileage rates determined?. How does the IRS determine its so-called safe harbor rates for mileage reimbursement? Learn more. The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. A mileage log should include the date, the destination, the business purpose, the odometer reading at the start and end of travel and the total mileage for. As discussed in other areas of this guide, every year new mileage rates come out. These rates, set by the Internal Revenue Service (IRS). What is the IRS Mileage Rate? · $ per mile for business · $ per mile for medical purposes · $ per mile for moving (used only for Armed Forces. Learn about your IRS mileage rate, and see how depreciation factors into the equation. This guide will walk you through the complete list of the IRS mileage rates, what counts, what doesn't count, and how to keep a record for compliance. In accordance with CSR , the state mileage allowance shall be computed at a rate not to exceed the Internal Revenue Service standard mileage rate. This announcement informs taxpayers that the Internal Revenue Service is modifying Notice , I.R.B. , by revising the optional standard mileage. The mileage rates show a cent increase in the business mileage rate ( cents in ) and a 1 cent decrease in the rate for medical and moving.

Home Loan Interest Rate Prediction

Lawrence Yun of the National Association of Realtors® predicts that mortgage loan interest rates could fall back down and hold steady at 6 percent in the. Mortgage Rate Predictions for 20· loanDepot: Mortgage rates could fall below 6% in Q4 · BrightMLS: Year, fixed rate to hover below % in Q4. Wells Fargo sits at the low end of the group, predicting the average year fixed interest rate to settle at % for Q3. We currently have a lower annual inflation rate of between and percent. Accordingly, our forecasts still anticipate falling interest rates at the short. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. Mortgage rates rose above 7% in April and these higher rates slowed the housing market. Outlook | April 18, Economic, Housing and Mortgage Market Outlook. We can expect slightly lower rates in September — perhaps in the mid- or even low-6% range — but don't expect rates to drop very steeply. The average contract interest rate for year fixed-rate mortgages with conforming loan balances ($, or less) declined by 14bps to % in the week. → Mortgage rates currently average % for year fixed loans. Lawrence Yun of the National Association of Realtors® predicts that mortgage loan interest rates could fall back down and hold steady at 6 percent in the. Mortgage Rate Predictions for 20· loanDepot: Mortgage rates could fall below 6% in Q4 · BrightMLS: Year, fixed rate to hover below % in Q4. Wells Fargo sits at the low end of the group, predicting the average year fixed interest rate to settle at % for Q3. We currently have a lower annual inflation rate of between and percent. Accordingly, our forecasts still anticipate falling interest rates at the short. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. Mortgage rates rose above 7% in April and these higher rates slowed the housing market. Outlook | April 18, Economic, Housing and Mortgage Market Outlook. We can expect slightly lower rates in September — perhaps in the mid- or even low-6% range — but don't expect rates to drop very steeply. The average contract interest rate for year fixed-rate mortgages with conforming loan balances ($, or less) declined by 14bps to % in the week. → Mortgage rates currently average % for year fixed loans.

What is the Mortgage Interest Rate Prediction for the Future? Unfortunately, homebuyers aren't likely to see the historically low mortgage rates that and. In turn, interest rates for home loans tend to increase as lenders pass on the higher borrowing costs to consumers. Lenders. A lender with physical locations. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Wells Fargo sits at the low end of the group, predicting the average year fixed interest rate to settle at % for Q3. The year fixed-rate mortgage averaged % APR, down 23 basis points from the previous week's average, according to rates provided to NerdWallet by Zillow. There's no surefire way to know how much of a drop to expect, but experts predict they could reach 6%. Stay abreast of market trends if you're looking to buy a. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type. No, the rate predictions covered here aren't just for FHA mortgages, but FHA home loans are part of those observations. Business Insider repeats the Fannie Mae. Historical record of single-family, one- to four-unit loan origination estimates. Last updated August Historical Mortgage Finance Forecast. Historical. The monthly Economic Outlook includes the Economic Developments Commentary, Economic Forecast, and Housing Forecast – which detail interest rate movement, the. As of May , Australia's current interest rate is %. This is a far cry from the % we experienced just 4 years ago, which is causing grief for a lot. How your mortgage interest rate is determined. Mortgage and refinance rates Your interest rate remains the same over the life of the loan. This is a. What is the Mortgage Interest Rate Prediction for the Future? Unfortunately, homebuyers aren't likely to see the historically low mortgage rates that and. This is MBA's forecast of key indicators of economic health such as GDP, consumer spending, employment and interest rates. View Archive. This is MBA's mortgage. This is MBA's forecast of key indicators of economic health such as GDP, consumer spending, employment and interest rates. View Archive. This is MBA's mortgage. To pull down inflation, the RBA has to increase the cash rate, which leads to higher savings interest rates and loan rates. Higher savings and loan interest. In this article, we examine expert and bank forecasts to explore what the future might hold for you as a borrower or homeowner, and the broader economy. The average lender's top tier 30yr fixed rate fell to the lowest level since April last week. That's down more than % over the past 5 months. NEW. It serves as a baseline that most banks use to determine what interest rate to give customers who want to either open a new credit card or take out a home loan.

1 2 3 4 5